PBCO FINANCIAL CORPORATION REPORTS FIRST QUARTER 2025 RESULTS

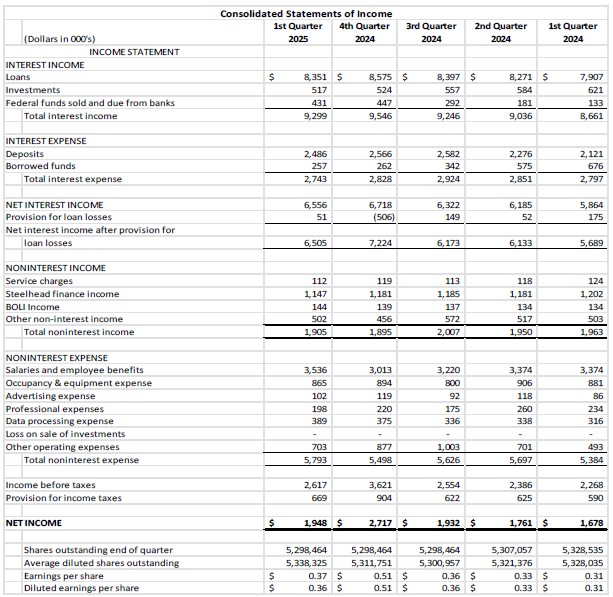

Medford, Oregon – April 23, 2025 – PBCO Financial Corporation (OTCPK: “PBCO”), the holding company (the “Company”) of People’s Bank of Commerce (the “Bank”), today reported net income of $1.9 million and earnings per share of $0.37 for the first quarter of 2025, compared to net income of $1.7 million and $0.31 per share for the first quarter of 2024.

Highlights

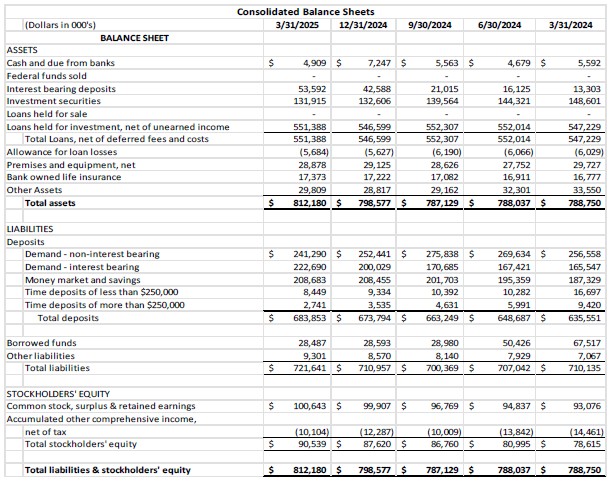

- 7.6% increase in total deposits compared to the first quarter of 2024

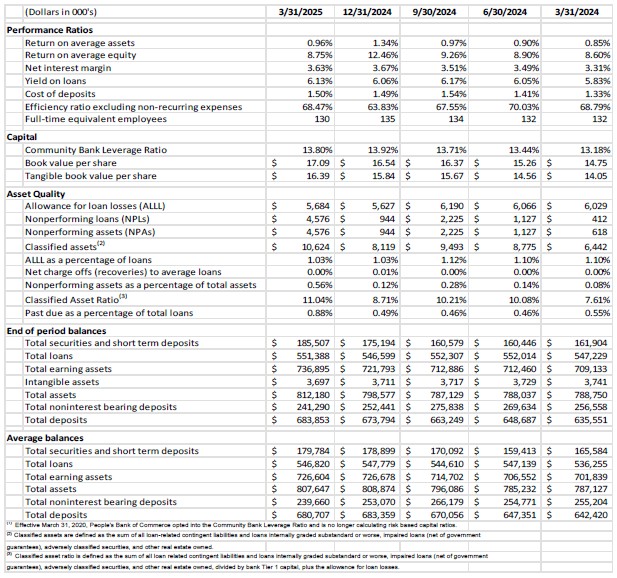

- Net interest margin increased to 3.63% compared to 3.31% in first quarter of 2024

- Net income increased by 16.09% versus the first quarter of 2024

- Tangible book value per share of $16.39, an increase of 16.7% versus the first quarter of 2024

- Paid cash dividends of $0.229 per share in the quarter

“I am pleased to report the Company’s first quarter operating results of 2025. “The strong financial performance is evidenced by the improved net interest margin, net income growth, and tangible book value per share growth compared to the first quarter of 2024,” reported Julia Beattie, President and CEO.

The Bank’s loan portfolio increased to $551.0 million, or an increase of 0.8% over the prior year, while the yield on the loan portfolio increased to 6.13% during the first quarter of 2025 compared to 5.83% in the first quarter of 2024. “The loan portfolio remained relatively flat compared to prior year, primarily due to loan prepayments that occurred over the last two quarters,” noted Beattie.

Total deposits grew 1.5% during the first quarter of 2025 and 7.6% since the first quarter of 2024. “The Bank remains focused on growing deposits to support our loan growth,” reported Beattie. “The market trends over the past three years have demonstrated the importance of having a strong core deposit base, which is a key strength of People’s Bank throughout its history,” added Beattie.

The investment portfolio decreased 11.2% to $131.9 million during the first quarter of 2025 from $148.6 million at the end of the first quarter of 2024. Due to lower market rates on investments over the year and reductions in the investment portfolio as investments were called or matured, the AOCI decreased to $10.1 million at the end of the first quarter of 2025 compared to $14.5 million at the end of the first quarter of 2024.

Credit quality remains strong, although there was an increase in non-performing loans during the quarter due to the downgrade of a relationship with $2.1 million in outstanding loans. The Bank has adequate collateral coverage and does not anticipate any losses as a result of this downgrade. The allowance for credit losses as a percentage of loans remained flat at 1.03% from the prior quarter. During the quarter, the provision expense was $51 thousand.

Non-interest income was $1.9 million in the first quarter, down $58 thousand from the first quarter of 2024. Revenue from Steelhead, the Bank’s factoring division, was down $55 thousand over the same period, while other non-interest income was flat with the first quarter of 2024.

Non-interest expenses totaled $5.8 million in the first quarter, up $409 thousand from the first quarter of 2024, with the increase largely attributed to increased personnel expense of $162 thousand and other non-interest expenses of $210 thousand.

The Bank’s leverage ratio was 13.80% as of March 31, 2025, compared to 13.92% as of December 31, 2024. The Company’s tangible common equity was $86.8 million as of March 31, 2025, compared to $83.9 million as of December 31, 2024. During the quarter, the Company paid a cash dividend of $0.229, which was the first cash dividend paid to shareholders since 2009.

About PBCO Financial Corporation

PBCO Financial Corporation’s stock trades on the over-the-counter market under the symbol PBCO. Additional information about the Company is available in the investor section of the Company’s website.

Founded in 1998, People’s Bank of Commerce is a full-service, commercial bank headquartered in Medford, Oregon with branches in Albany, Ashland, Central Point, Eugene, Grants Pass, Jacksonville, Klamath Falls, Lebanon, Medford, and Salem.

"Safe Harbor" Statement under the Private Securities Litigation Reform Act of 1995:

This release includes forward-looking statements intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally can be identified by the use of words or phrases such as "believes," "expects," "anticipates," "foresees," "forecasts," "estimates," “plans,” “projects,” or other words or phrases of similar import indicating that the statement addresses some future result, occurrence, plan, or objective. Similarly, statements herein that describe People’s Bank’s business strategy, outlook, objectives, plans, intentions or goals also are forward-looking statements. All such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those expressed or implied in forward-looking statements.