PBCO FINANCIAL CORPORATION REPORTS 4TH QUARTER AND ANNUAL 2024 RESULTS

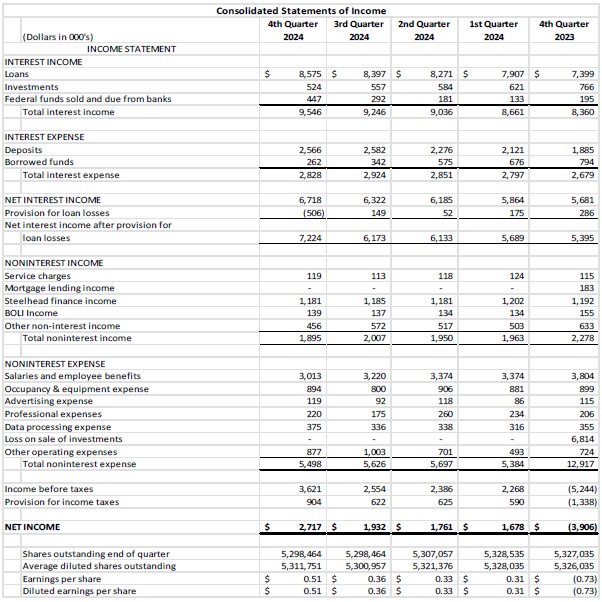

Medford, Oregon – January 22, 2025 - PBCO Financial Corporation (OTCPK: “PBCO”), the holding company (Company) of People’s Bank of Commerce (Bank), today reported net income of $2.7 million and earnings per share of $0.51 for the fourth quarter of 2024, compared to net income of $1.9 million and $0.36 per share for the third quarter of 2024. For the year ended 2024, earnings per share were $1.52 compared to $0.19 in 2023.

Highlights

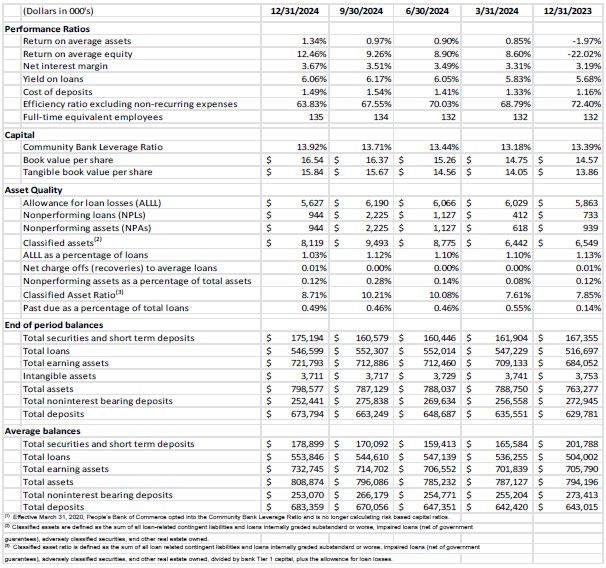

- Net interest margin of 3.67% which increased by 16 basis points compared to prior quarter and 48 basis points over the same quarter prior year

- Return on average assets increased to 1.34% compared to 0.97% in the prior quarter

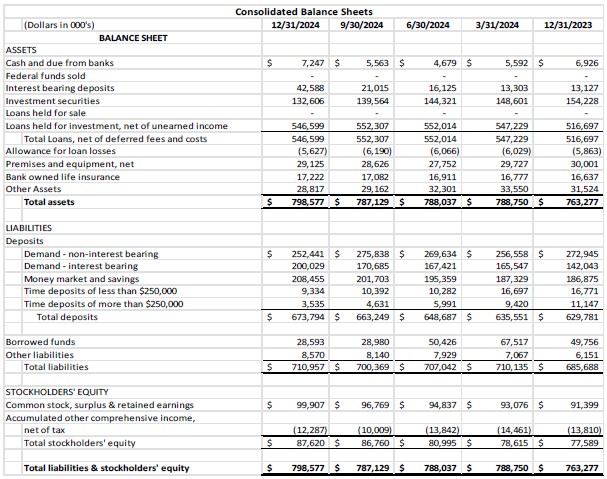

- 7.0% increase in total deposits compared to prior year

- Tangible book value per share increased to $15.84, compared to $13.86 at the prior year-end

“2024 was a pivotal year for the Bank after taking action on two key strategic business decisions at the end of 2023. We sold a portion of the investment securities portfolio to reposition our balance sheet and improve the net interest margin and we dissolved our mortgage department which contributed to improved operating efficiency,” reported Julia Beattie, President & CEO. “I am pleased that we were able to achieve our goals of improved profitability and positive deposit growth during my first full year as CEO, and I look forward to building on this progress moving forward,” added Beattie.

During 2024, the Bank’s loan portfolio increased 5.8% year-over-year, while the yield on the loan portfolio increased to 6.06% during the fourth quarter of 2024 compared to 5.68% in the fourth quarter of 2023. “Loan growth was relatively flat during the 2nd half of 2024, primarily due to prepayments that occurred in December 2024, but the loan pipeline remained strong at year-end,” added Beattie.

Total deposits grew 1.6% during the fourth quarter and 7.0% for the year ended 2024.

The investment portfolio decreased 5.0% to $132.6 million during the fourth quarter of 2024 from $139.6 million at the end of the third quarter. Due to higher market rates on investments during the quarter, the Company’s AOCI book loss increased to $12.3 million at the end of the fourth quarter compared to $10.0 million at the end of the third quarter.

Non-interest income was $1.9 million in the fourth quarter, down $112 thousand from the third quarter of 2024. Revenue from Steelhead, the Bank’s factoring division, was relatively unchanged compared to prior quarter, while other non-interest income was down $116 thousand due to a non-recurring recovery of expenses in the third quarter from a non-performing loan. For the year, non-interest income was down $1.2 million versus 2023.

Non-interest expenses totaled $5.5 million in the fourth quarter, down $128 thousand from the previous quarter, with the decrease largely attributed to a reduction in personnel expense. Occupancy and equipment expenses increased in the quarter due to the opening of the permanent Eugene branch location and expense incurred to terminate the remaining lease contract on the temporary location. For the year, non-interest expenses were 7.5% less than in 2023 after excluding the 2023 loss on partial liquidation of the investment portfolio.

The Bank’s leverage ratio was 13.92% as of December 31, 2024, compared to 13.71% as of September 30, 2024. The Company’s tangible common equity was $83.9 million as of December 31, 2024, compared to $83.0 million as of September 30, 2024.

About PBCO Financial Corporation

PBCO Financial Corporation’s stock trades on the over-the-counter market under the symbol PBCO. Additional information about the Company is available in the investor section of the Company’s website.

Founded in 1998, People’s Bank of Commerce is a full-service, commercial bank headquartered in Medford, Oregon with branches in Albany, Ashland, Central Point, Eugene, Grants Pass, Jacksonville, Klamath Falls, Lebanon, Medford, and Salem.

"Safe Harbor" Statement under the Private Securities Litigation Reform Act of 1995:

This release includes forward-looking statements intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally can be identified by phrases such as People’s Bank or its management "believes," "expects," "anticipates," "foresees," "forecasts," "estimates" or other words or phrases of similar import. Similarly, statements herein that describe People’s Bank’s business strategy, outlook, objectives, plans, intentions or goals also are forward-looking statements. All such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those in forward-looking statements.