PBCO Financial Corporation Reports Q3 2023 Earnings

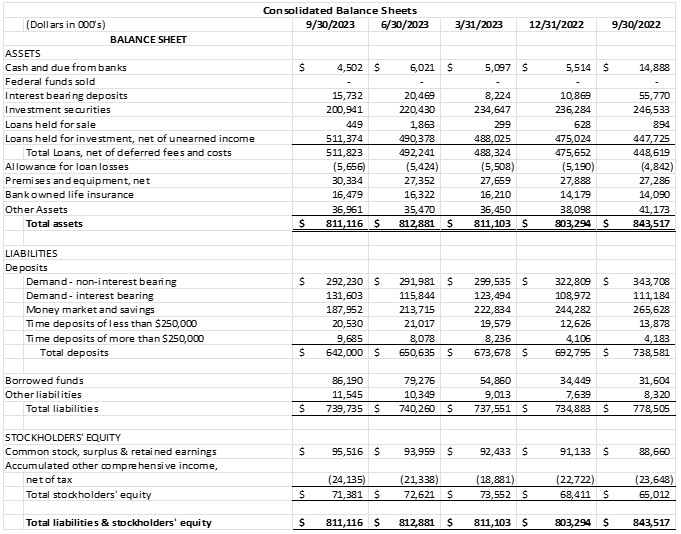

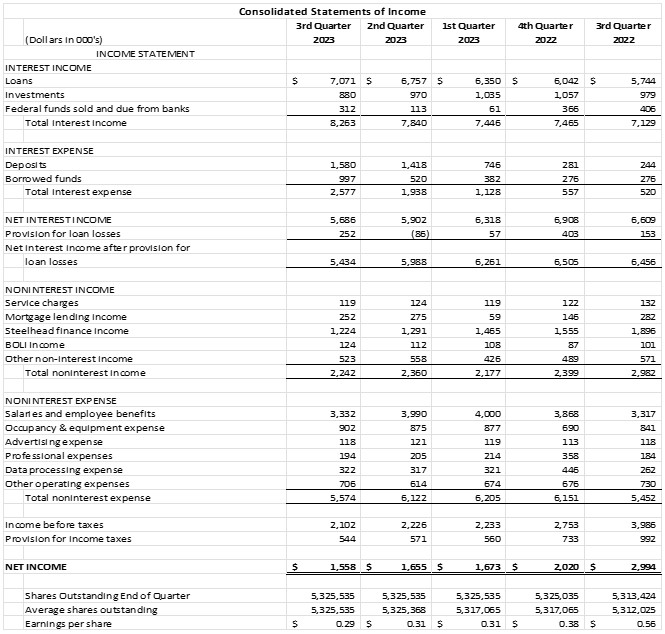

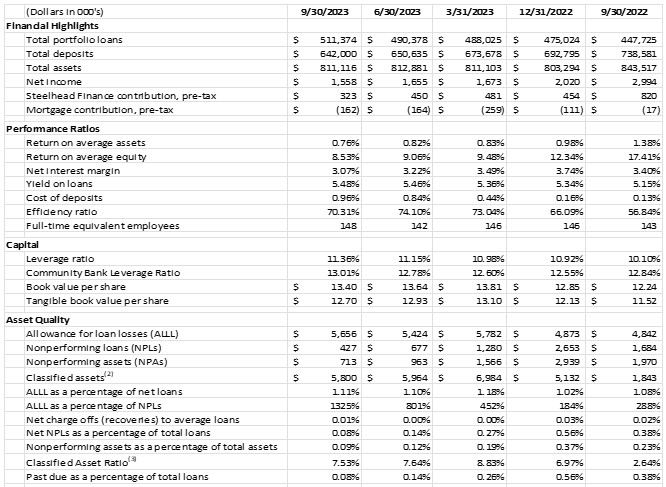

Medford, Oregon – October 25, 2023-PBCO Financial Corporation (OTCPK: “PBCO”), the holding company (Company) of People’s Bank of Commerce (Bank), today reported earnings of $1.56 million and earnings per diluted share of $0.29 for the quarter ended September 30, 2023, compared to $1.66 million and $0.31 per diluted share for the quarter ended June 30, 2023.

Highlights

- Portfolio loans increased 7.7% year-to-date

- Credit quality remains strong with non-performing assets to total assets of 0.09%

- Total non-interest expense declined 9.0% during the quarter from expense containment efforts

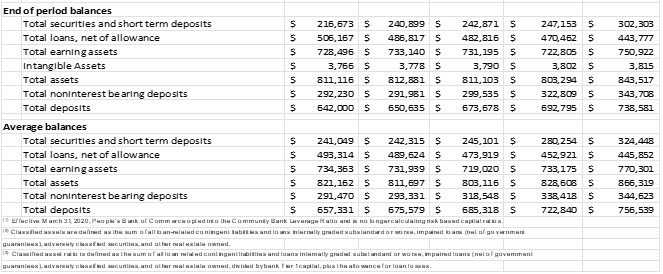

“Third quarter loan growth outpaced the prior two quarters, with a concerted effort toward high quality loan growth within the bank’s markets, especially the new Eugene branch that opened in March 2023,” reported Julia Beattie, President and Chief Executive Officer. Loans increased $21.0 million in the quarter, or 4.28%, compared to the second quarter of 2023. “In spite of higher borrowing costs, we continued to experience strong demand for loans through the end of the quarter,” added Beattie.

Non-performing assets continued to improve in the third quarter to 0.09%, as a percentage of total assets, versus 0.12% in the second quarter 2023. During the third quarter, the Allowance for Credit Losses increased by $252 thousand, primarily the result of strong loan growth over the prior quarter.

Deposits decreased $8.6 million during the quarter, a 1.3% decline from the second quarter of 2023. “Deposits continued to contract during the quarter, given continued pressure on interest rates, although at a slower pace than experienced over the prior three quarters,” commented Beattie. “The bank has focused on retaining core deposits while acknowledging that the pressure on rates has added to margin compression within the Bank,” continued Beattie. Funding costs increased over the prior quarter as a result of rising deposit rates and borrowing expenses related to the advance from the Bank Term Funding Program taken at the end of second quarter, which resulted in the incremental borrowed funds interest expense of $477 thousand in the third quarter.

The investment portfolio decreased 8.8% to $200.9 million in third quarter of 2023 from $220.4 million at the end of the second quarter 2023. This decrease is the result of maturing investments being reinvested in loan growth. The average life of the portfolio was 4.5 years at the end of the third quarter. Securities income was $0.88 million during the quarter, a yield of 1.66%, versus $0.97 million, and a yield of 1.76% for the second quarter of 2023. As of September 30, 2023, the net after tax unrealized loss on the investment portfolio was $24.1 million versus $21.3 million as of June 30, 2023, due to increased market rates. Highly rated government agency and government sponsored agency investments comprise 94.5% of the investment portfolio with the balance of approximately 4.6% held in municipal investments and 0.9% held in corporate sub-debt issued by community banks. As of third quarter 2023, liquid assets to total assets were 14.8%, including the market value of the investment portfolio less pledged investments.

Third quarter 2023 non-interest income totaled $2.2 million, a decrease of $118 thousand from the second quarter of 2023. The slight decrease was primarily driven by a reduction in factoring revenue from Steelhead Finance, which declined by 5.2%, or $67 thousand, from the prior quarter. “Our factoring division has experienced the effects of the current economic conditions on the transportation industry. Factoring volumes for the industry nationwide are down approximately 33% from last year’s average,” reported Bill Stewart, President of Steelhead Finance. Mortgage revenue was down $23 thousand in the quarter, demonstrating continued reduction in mortgage demand attributed to elevated rates.

Non-interest expenses totaled $5.6 million in the third quarter, down $548 thousand from the previous quarter. The reduction in expenses was the result of a decrease in personnel expense of $658 thousand versus second quarter due to expense containment efforts, a 16.5% decrease.

As of September 30, 2023, the Tier 1 Capital Ratio for PBCO Financial Corporation was 11.36% with total shareholder equity of $71.4 million. During the quarter, the Company continued to augment capital through earnings. The Tier 1 Capital Ratio for the Bank was 13.01% at quarter-end, up from 12.78% as of June 30, 2023. Tangible Capital was $67.6 million, or 8.34% as of September 30, 2023, versus second quarter of 2023 at $68.8 million or 8.47%.

About PBCO Financial Corporation

PBCO Financial Corporation’s stock trades on the over-the-counter market under the symbol PBCO. Additional information about the Company is available in the investor section of the Company’s website.

Founded in 1998, People’s Bank of Commerce is a full-service, commercial bank headquartered in Medford, Oregon with branches in Albany, Ashland, Central Point, Eugene, Grants Pass, Jacksonville, Klamath Falls, Lebanon, Medford, and Salem.

"Safe Harbor" Statement under the Private Securities Litigation Reform Act of 1995:

This release includes forward-looking statements intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally can be identified by phrases such as People’s Bank or its management "believes," "expects," "anticipates," "foresees," "forecasts," "estimates" or other words or phrases of similar import. Similarly, statements herein that describe People’s Bank’s business strategy, outlook, objectives, plans, intentions or goals also are forward-looking statements. All such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those in forward-looking statements.